| William Langley and Gloria Li in Hong Kong

Appotronics is adapting its laser equipment for carmakers as they seek to outdo each other on in-car entertainment

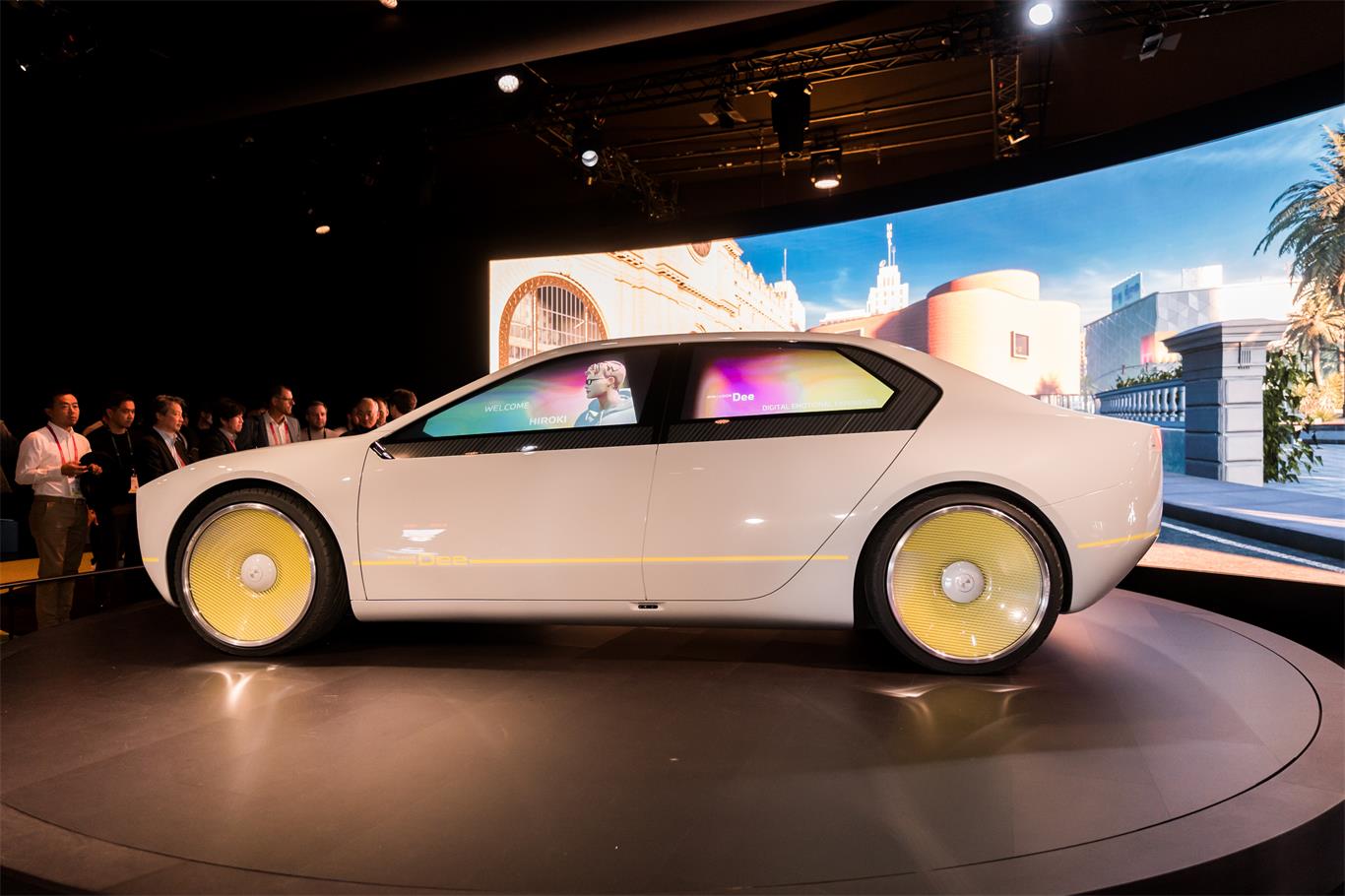

China’s top maker of laser cinema projectors is turning its beams on electric vehicles, as cut-throat competition among domestic carmakers creates demand for advanced displays and new kinds of in-car entertainment to make their models stand out.

Appotronics — laser display tech provider to more than 30 percent of China’s cinemas and with a 70-80 percent share of the country’s market for laser movie projectors — is now offering cinematic experiences to back-seat passengers with big-screen displays.

Its products can also project route information on to windscreens for drivers and cast personalised messages on to the road for pedestrians from the car’s headlamps, such as “Stop” warnings to walkers wearing headphones.

The Shenzhen-based company’s founder and chair Li Yi hopes between 10 and 30 per cent of this year’s revenues will come from EV equipment, up from “almost nothing” in 2023. Analysts expect group revenues to grow 25 per cent to Rmb3bn ($420mn) this year, according to a Bloomberg poll.

“The competition [has] become . . . fierce, so it does offer . . . some opportunity for us,” Li told the Financial Times.

Investment in EV tech helped push up Appotronics’ research and development spending by nearly 10 per cent in the first half of last year, according to its earnings report.

“They’re moving fast to put the latest technology to use,” Gong added, noting that there is a wide range of potential partners in China to produce in-car entertainment systems that include internet connectivity, large screens and voice control as standard features.

China’s BYD, the world’s largest EV maker, plans to add a range of new features to its cars, including vehicle-mounted drones and detachable steering wheels to play in-car video games.

“I think the Chinese EV makers . . . [initiated] this disruption, so they are more motivated to continue to carry on,” Li said.

Li added that while customers like BYD and Huawei exerted “tremendous” price pressure on Appotronics, EV suppliers could be likely to reduce costs further as the technology matures.

“It would be tough for [carmakers] if there’s not much space to reduce costs. But for us, it’s a new technology, so by default, we have to reduce the cost,” he said.

China’s carmakers are engaged in a price war as sluggish consumer demand, a glut of new vehicles and slowing economic growth drag down prices. Marques are introducing increasingly sophisticated in-car technology to help differentiate their models from the crowd and entice consumers.

“Compared to Europe and the US, there are more players in the Chinese market. In such a highly competitive environment, local car brands are being forced to come up with innovations in order to find their footing,” said Paul Gong, head of China automotive research at UBS.

Xpeng, another Chinese carmaker, has unveiled vehicles that can produce three-dimensional maps of surroundings, while Li Auto boasts built-in refrigerators and drink warmers in models that can be parked remotely through smartphone applications.

He pointed to the Huawei-backed Aito M9, which he said Appotronics equipped with a rollout 32-inch screen, transforming the cabin into a road-going cinema. Appotronics’ projectors can also display text and images on internal surfaces of the car.